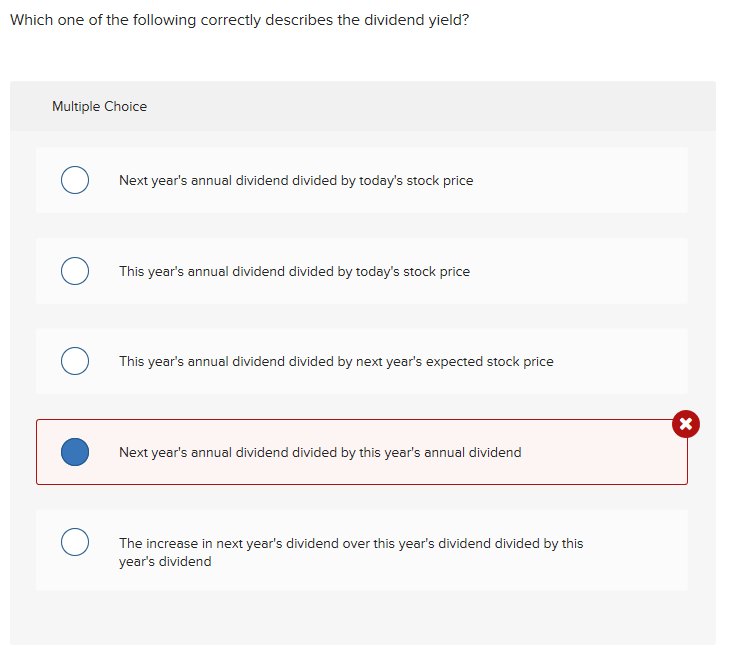

Which One of the Following Correctly Describes the Dividend Yield

The dividend yield is the dividend per year as a percent of the stock price at the time when the dividend is paid. Which one of the following correctly describes the dividend yield.

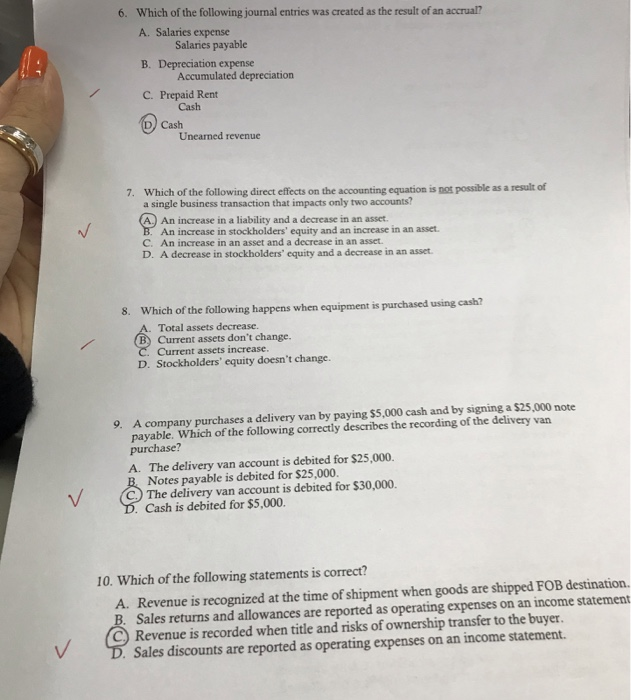

Solved Which One Of The Following Correctly Describes The Chegg Com

See the answer See the answer done loading.

. CThis years annual dividend divided by next years expected stock price. DDividends will yield a certain return to a person buying the stock today. If the dividend yield remains at its pre-announcement level then you know the stock.

Which one of the following correctly describes the dividend yield. Dividends paid at the end of the period income from investment Capital Gains beginning price of stock. A yield to maturity that is less than the coupon rate.

Next years annual dividend divided by todays stock price. Next years annual dividend divided by todays stock price b This years annual dividend divided by todays stock price Q This years annual dividend. Next years annual dividend divided by todays stock price.

If market yields dont change then the value of the Treasury Note will decrease each day until its price is equal to its face value at expiry. Use the these tools to. EThe increase in next years dividend over this.

This years annual dividend divided by next years expected stock priceD. The capital gains yield is positive. Compute the percentage total return.

30 Which one of the following correctly describes the dividend yield. Bayside Marina just announced it is decreasing its annual dividend from 164 per share to 150 per share effective immediately. This years annual dividend divided by todays stock price C.

Which one of the following statements best defines the efficient market from BUSI 2504 at Carleton University. Next years annual dividend divided by todays stock price D. This years annual dividend divided by todays stock price c.

BDividends per year as a percentage of todays stock price are known. Was unaffected by the announcement. Capital gains 4033-3737 9 Pt1 - Pt Pt.

The dividend yield is greater than the capital gains yield. C It seeks to curb any attempt by directors to use inappropriate accounting policies. If the dividend yield remains at its pre-announcement level then you know the stock price.

Dividend yield 18537 5. The capital gain would have been less had Stacy not received the dividends. Next years annual dividend divided by todays stock priceB.

Compute a dividend yield for a given stock that pays a 250 annual dividend and a price of 100. The increase in next years dividend. Next years annual dividend divided by todays stock price.

Percentage return 014 on the dollar invested. Anext years annual dividend divided by todays stock price Bthis years annual dividend divided by todays stock price Cthis years annual dividend divided by next years expected stock price Dnext years annual dividend divided by this years annual dividend. Which one of the following correctly describes the dividend yield.

A It seeks to safeguard the publics confidence in financial accounts. An unsecured debt of a firm with a maturity of 10 years or more is called an. This years annual dividend divided by next years expected stock price.

This years annual dividend divided by todays stock priceC. Which one of the following correctly describes the dividend yield-Next years annual dividend divided by this years annual dividend-The increase in next years dividend over this years dividend divided by this years dividend-This years annual dividend divided by next years expected stock price. Which one of the following correctly describes the dividen yield.

Tap card to see definition. The dividend yield is expressed as a percentage of the selling price. ANext years annual dividend divided by todays stock price.

Quiz Worksheet Goals. The annual dividend amount divided by the face value of the stockE. Next years annual dividend divided by this years annual dividend.

Next years annual dividend divided by this years annual dividend e the increase in next years dividend over this years. The total dollar return per share is 3. If the dividend yield remains at its pre-announcement level then you know the stock price.

By Berries Emulous of fame Grand 151k points. This years annual dividend divided by todays stock price. Bayside Marina just announced it is decreasing its annual dividend from 164 per share to 150 per share effective immediately.

This years annual dividend divided by next years expected stock price D. Which one of the following scenarios accurately describes a condition in which resonance can occur. What was the dividend yield and the capital gains yield.

This problem has been solved. The increase in next years dividend. Which one of the following correctly describes the dividend yield.

Which one of the following correctly describes the dividend yield. Next years annual dividend divided by todays stock price. Total Returns -1361 Dividend Yield 167 Capital Gains Yield -1528 Suppose a stock had an initial price of 57 per share paid a dividend of 17 per share during the year and had an ending share price of 63.

The annual coupon divided by the face value of a bond is called the. This years annual dividend divided by next years expected stock price d. Next years annual dividend divided by this years annual dividend E.

Which one of the following correctly describes the dividend yield. Which of the following statements correctly describes characteristics of an Australian 13-week Treasury note. Finance questions and answers.

Which of the following statements about the accounting regulatory framework is not correct. Group of answer choices A. Next years annual dividend divided by this years annual dividend.

Which one of the following correctly describes the dividend yield. Which one of the following correctly describes the dividend yield. Find a dividend for a given stock with a price of.

CDividends per year as a percentage of the stock price at the time when dividends are paid are known. Click again to see term. Next years annual dividend divided by todays stock price B.

This years annual dividend divided by todays stock price C. This years annual dividend divided by next years expected stock price D. Which one of the following correctly describes the dividend yield.

Which one of the following correctly describes the dividend yield. B It ensures maximisation of dividend yield. BThis years annual dividend divded by tomorrows stock price.

Which one of the following correctly describes the effect of an increase in a bonds yield to maturity.

Chapter 13 Distributions To Shareholders Dividends And Repurchases S E Chapter 13 Studocu

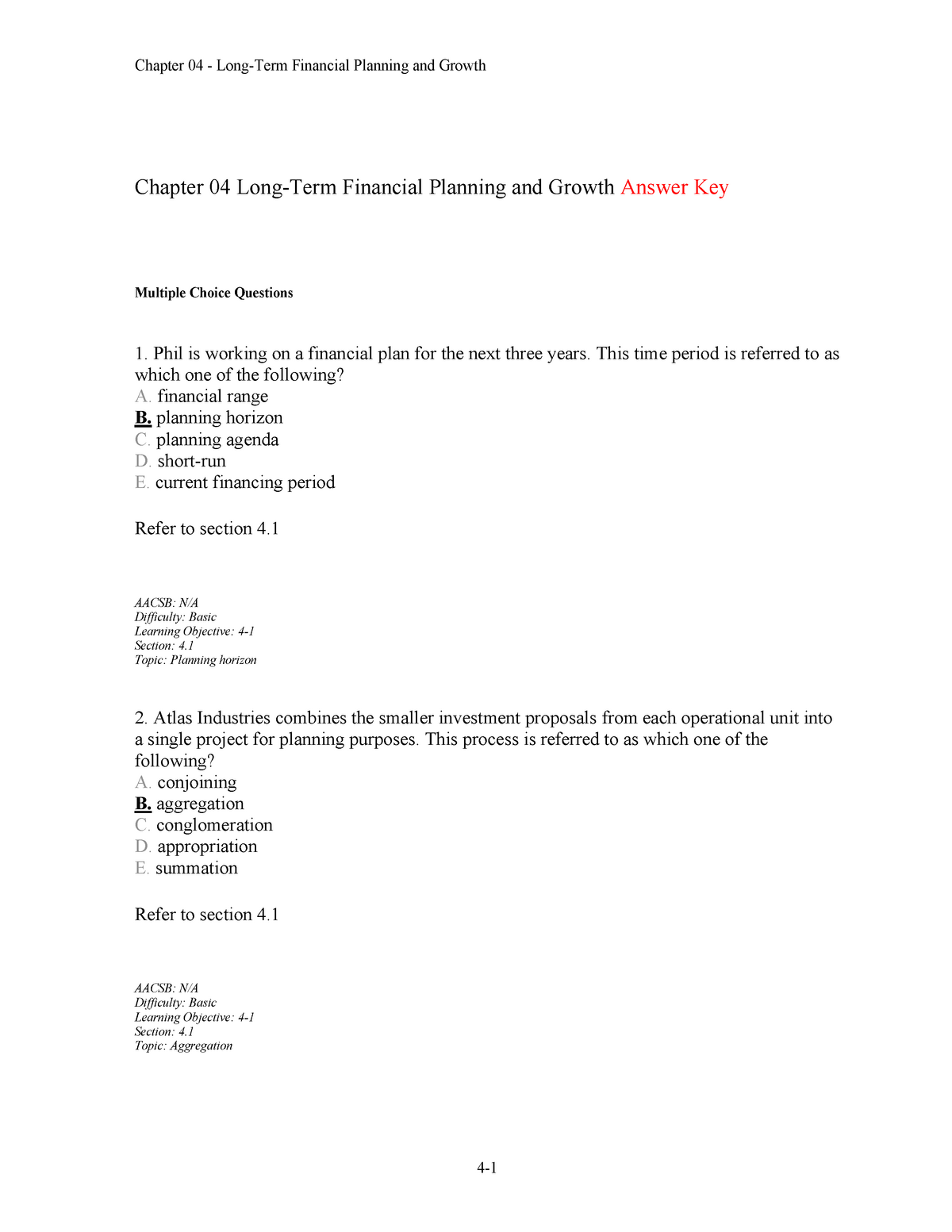

Parcial Chapter 15 5 May 2020 Questions And Answers Chapter 04 Long Term Financial Planning And Studocu

Finance 411 Exam 1 Flashcards Quizlet

Chapter 22 Multiple Choice Questions

Chapter 04 Long Term Financial Planning And Growth Test Bank Chapter 04 Long Term Financial Studocu

Doc Ch2 Answer Khaliunaa Sukhbaatar Academia Edu

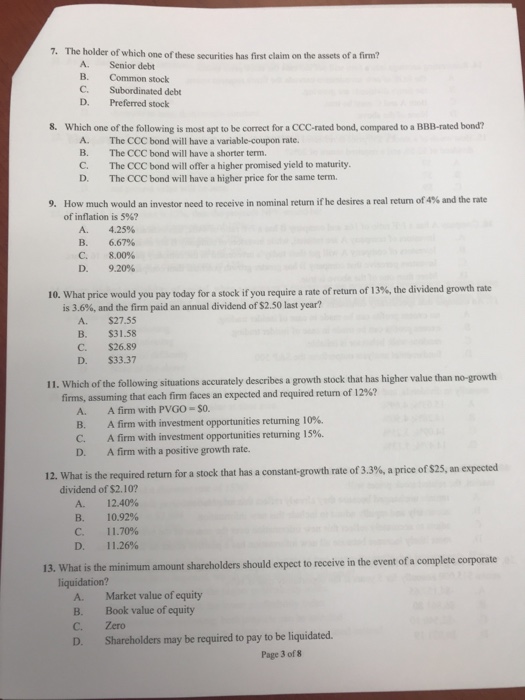

Solved 7 The Holder Of Which One Of These Securities Has Chegg Com

Why Are Dividend Yields Factored Into Beta Quora

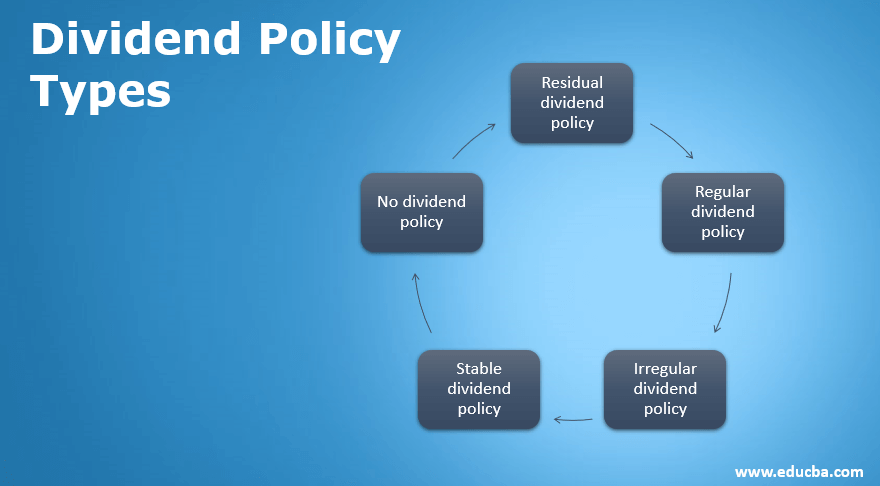

Dividend Policy Types Types Of Dividend Policy With Explanation

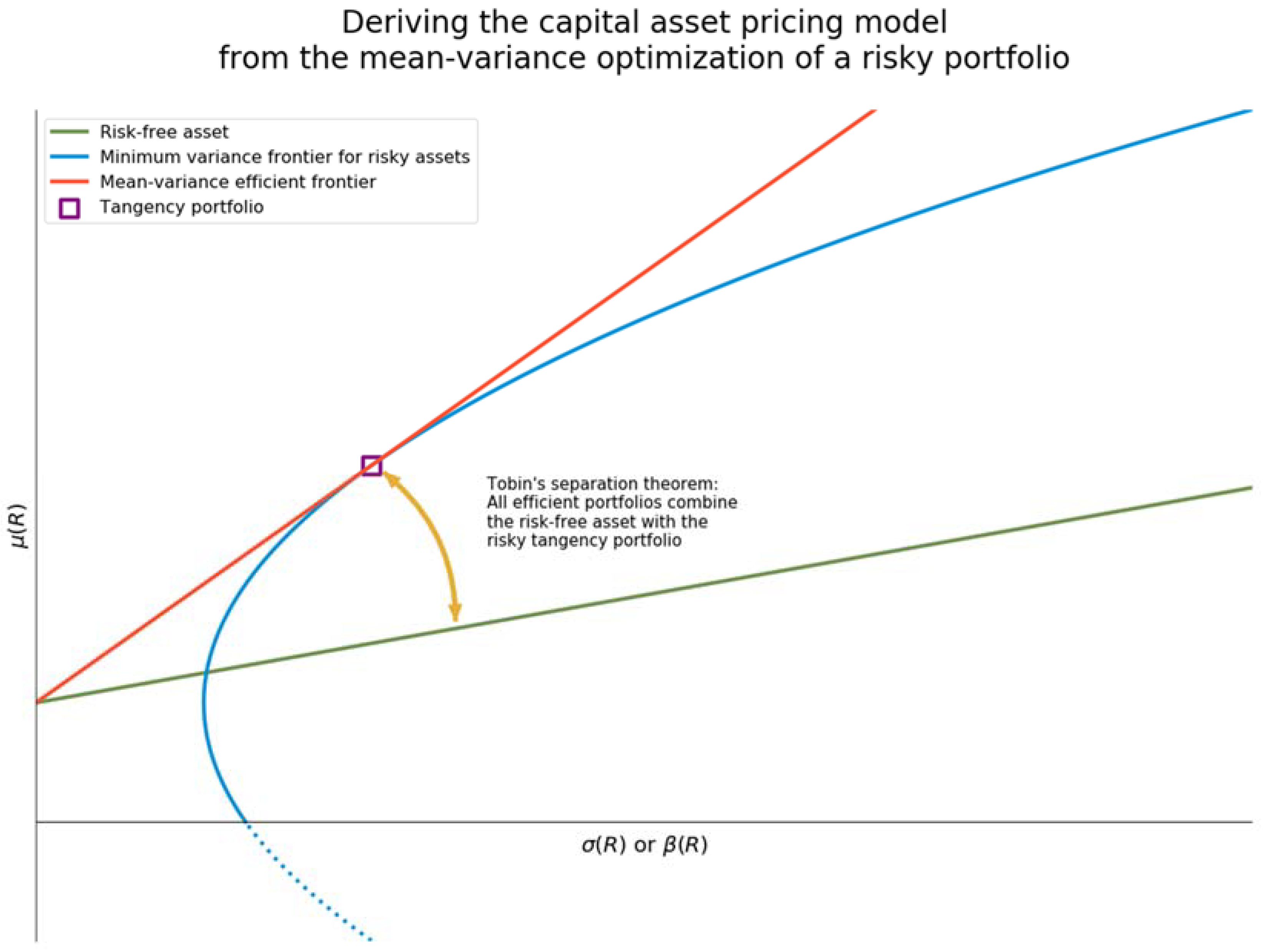

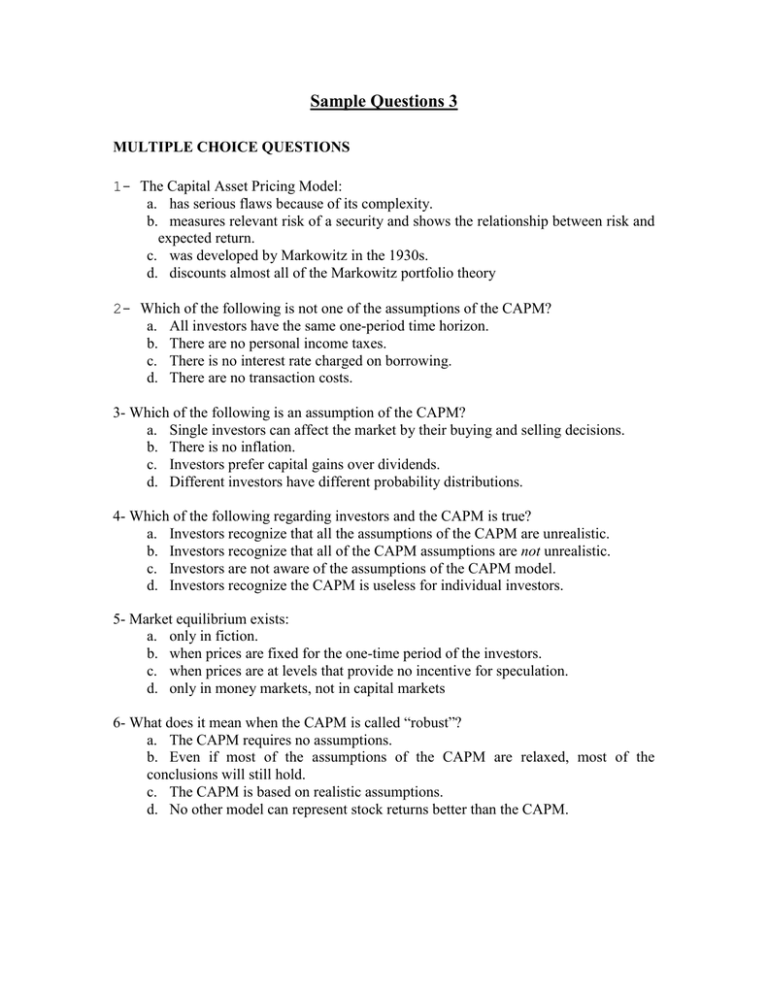

Encyclopedia Free Full Text The Capital Asset Pricing Model Html

Solved 1 Which Of The Following Statements Is Correct Chegg Com

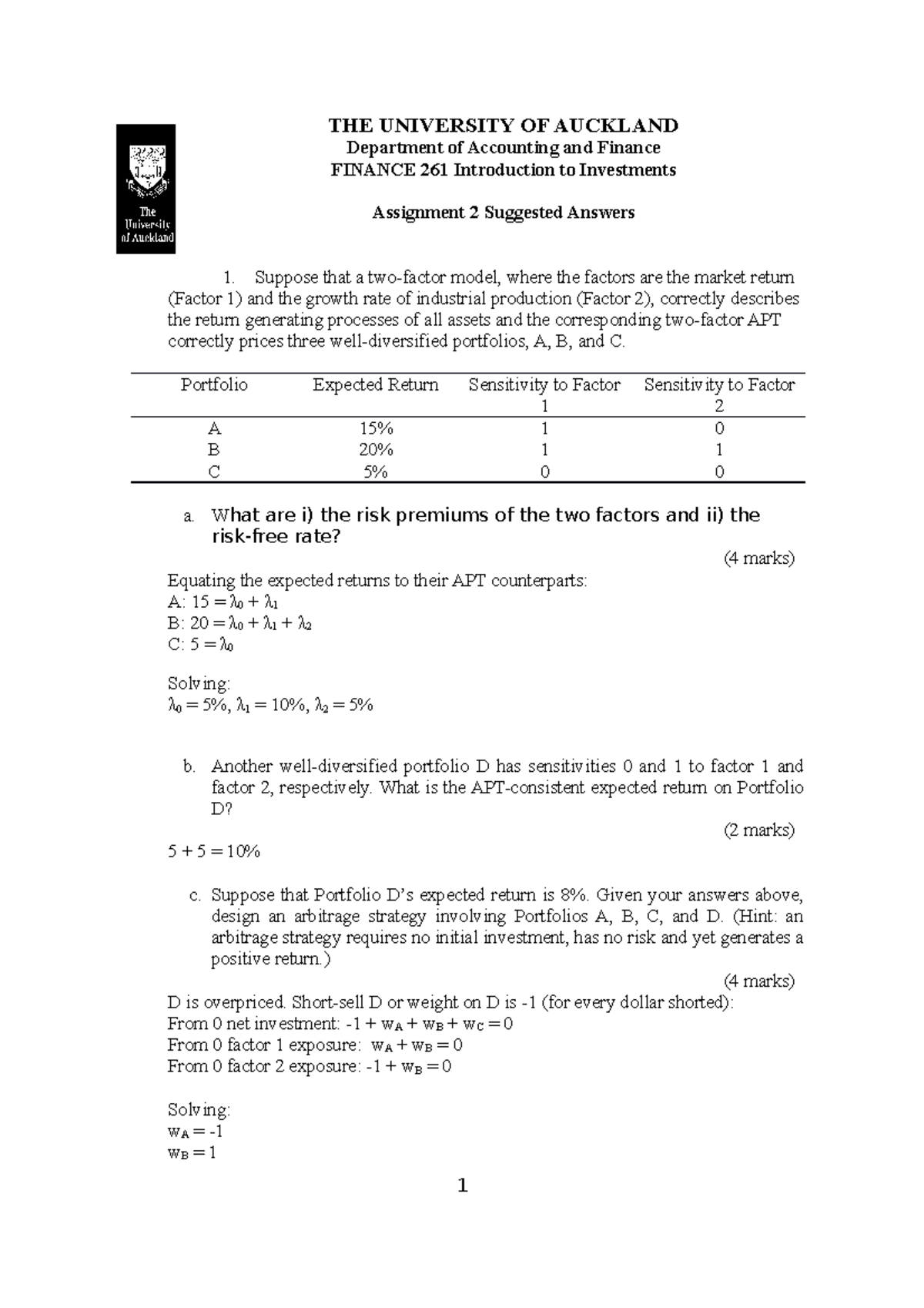

Assignment 2 Answers Introduction To Investments Finance261 Studocu

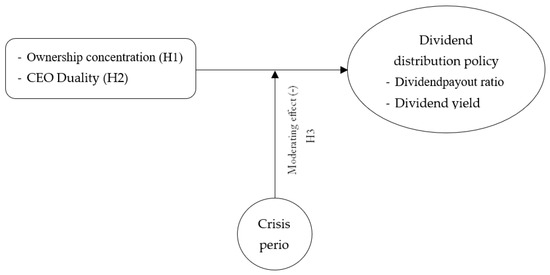

Ijfs Free Full Text Do Ceo Duality And Ownership Concentration Impact Dividend Policy In Emerging Markets The Moderating Effect Of Crises Period Html

University Of Waterloo Midterm Examination Pdf Free Download

/dividendyield-5c67fc5946e0fb00011a0c31.jpg)

Comments

Post a Comment